First, we need to know who is a 401k specialist. They provide retirement planning consultation with the vision, expertise, and cutting-edge technology essential to get success in the dynamic market to ensure the safe retirement of hardworking employees.

Here are the essential steps by focusing on which you can get a 401k specialist job.

THE PLANNING:

As a 401k advisor, you need to determine a 401k plan for your market and goals. You should think that are you aiming for a larger plan or a smaller plan

KNOWING THE BUSINESS:

There is so much to learn from those who are focused on retirement planning. The industry is constantly changing, and from beginners to experts, you need to take the time to keep your skills and knowledge base sharp. Gain in-depth trust education and training, as well as investment analysis and consulting expertise. You need to understand how their planning sponsors can help reduce their responsibilities. There are many resources for these types of education available on the internet.

PLAN EXPENSES:

One of the most basic responsibilities is always ensuring that your planning costs are reasonable. As well as many other aspects of overseeing a 401k, regular attendance is required. Manage expenses and conduct regular benchmarking. Especially when planning demographics and burgeoning assets change rapidly. One way to cut fees is to move assets to lower share classes as needed.

PAY ATTENTION TO THE RULES:

The 401k specialists should make sure that the plans and processes are being managed by the laws and rules in their region.

COMMUNICATION SKILLS:

Communication and training are essential when working to increase the effectiveness of your company’s 401k.

It allows employees to understand how to work with record holders as well as how to manage their accounts wisely. Vendors are not responsible for educating participants, but human resource professionals can add a personal touch. After all, they have a stronger relationship with their employees than with external consultants, and that relationship can help them understand the importance of planning for retirement.

Also, remember the importance of personal context. Each worker’s economic situation and goals are unique, and a 401k is only one component of economic health. Medical expenses, Student debt payments, mortgages, etc. affect severance pay for all employees.

DON’T WORK IN A VACUUM:

Keep this in mind, never lose sight of the big picture, Retirement savings must be visible in all situations in which they are taking place. In addition to considering the impact of retirement health care costs and other financial debt, look at a wider range of economic issues. Investing in behaviors that endanger retirement guarantees and the activities of participants monitor regularly. If people feel that they are not making the right decisions for their future, it is advisable to provide more detailed guidance.

DON’T FORGET THAT THIS IS AN ONGOING PROCESS:

Many employers consider the obligation to administer a 401k as an annual event. At one time, the management of personnel and other companies and consultants hired for that purpose checked the plan. After setting up, its operation is up to records managers and other vendors until the following year but things are not so simple and annual consideration is not enough.

Focus on how you can convince them of it?

If your workforce is quite young, your investment strategy is different from that of a company where employees are average enough to be middle-aged.

You can do this by monitoring performance against metrics defined in investment policies, such as benchmarks and comparisons with peer groups three times in a year, or most experts suggest conducting a full review of the provider every three to five years. You decide whether you can do a proper assessment on your own or whether you need to hire a consultant to cover everything. Your decisions depend on your abilities.

No matter what resource you use, most experts believe that it is the best way to compare providers who can issue a request for a proposal. It takes a lot of work to oversee a 401(k), but it’s easy to manage.

And if work is appreciated from time to time, your work will help your company and shape the economic future of its employees.

CONCLUSION:

We hope you have learned about being a 401k specialist. Just keep in mind the 401k specialist job description, and if you think it’s right for you, you can enroll in a 401k certification program.

Classical Naptime For Tots

Classical Naptime For Tots

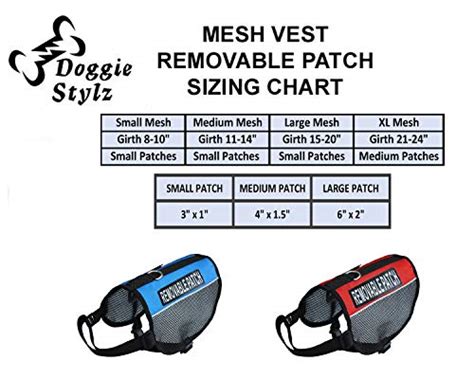

Doggie Stylz Set Of 2 Reflective Therapy Dog In Training Removable Patches Wit

Doggie Stylz Set Of 2 Reflective Therapy Dog In Training Removable Patches Wit

6 Pcs Service Dog In Trainingworkingstress Amp Anxiety Response Embroidere

6 Pcs Service Dog In Trainingworkingstress Amp Anxiety Response Embroidere

Service Dog In Training Patch With Hook Back And Reflective Lettering For Servic

Service Dog In Training Patch With Hook Back And Reflective Lettering For Servic

Four Paws Wee Wee Pee Pads For Dogs And Puppies Training L Gigantic Xl St

Four Paws Wee Wee Pee Pads For Dogs And Puppies Training L Gigantic Xl St

Pny 128gb Elite X Class 10 U3 V30 Microsdxc Flash Memory Card 100mbs

Pny 128gb Elite X Class 10 U3 V30 Microsdxc Flash Memory Card 100mbs

Academy Of Beasts V Shifter Romance

Academy Of Beasts V Shifter Romance

Beast Academy 5a Practice

Beast Academy 5a Practice

32gb Class 10 Sdhc Flash Memory Card Standard Full Size Sd Card Ush I U

32gb Class 10 Sdhc Flash Memory Card Standard Full Size Sd Card Ush I U

Go Power F 200 Class T 200 Amp Slow Blow Fuse Silver

Go Power F 200 Class T 200 Amp Slow Blow Fuse Silver

Blue Sea Systems 5116 Fuse A3tclass T 200a

Blue Sea Systems 5116 Fuse A3tclass T 200a

Eureka Peanuts Classic Characters Deco Kit 840227

Eureka Peanuts Classic Characters Deco Kit 840227

![Flutter & Dart - The Complete Guide [2022 Edition]](https://img-c.udemycdn.com/course/100x100/1708340_7108_5.jpg)