Despite its reputation as a dull, nerdy desk job, actuarial science may be exciting for those who enjoy crunching numbers and applying statistical analysis to real-world situations. It can be a rewarding career, with responsibilities ranging from anticipating corporate plans to advising higher-ups on prudent financial decisions.

This article will discuss the top actuarial science jobs that can lead you towards a successful career. Have a look.

Insurance actuarial analyst

The insurance sector employs a considerable number of actuarial science professionals and actuaries.

As an insurance actuarial analyst, you’ll utilize your statistical abilities and expertise to create and price insurance plans that take various factors into account. Before settling on a premium, an actuary specializing in medical insurance, for example, will analyze a person’s background, the present state of health, family background, and occupation.

As a result, an insurance actuary must have a strong understanding of calculus, statistics, and chance. You’ll also need extensive computer abilities to create sheets, databases, and statistical analysis tools, as well as the tremendous analytical ability to see how specific aspects may change the outcome of events.

Actuarial consultant

Actuarial consultants assess, manage, and provide financial risk advice to businesses. They analyze the likelihood of a given occurrence occurring and consider the economic costs that the company will have to endure due to it using financial and statistical ideas.

Unlike actuaries who serve insurance firms, consulting actuaries work with a wide range of clients, including insurers, tactful companies, banks, and regulatory agencies, to provide consultancy services. They may be in charge of reviewing pension schemes, managing the risks, pricing insurance plans, and determining appraisal values in mergers, among other things.

You’ll be expected to have a wide range of talents as an actuarial consultant, including advanced numeracy and IT skills, solid business judgment, and the capability to summarize and present complex technical data to non-specialists.

Business analyst

The abilities you gain from an Actuarial Science degree (strong numeracy skills, knowledge to decode complex data, and so on) begins preparing you for a profession as a business analyst, which entails analyzing an organizational framework, structure, and policies and suggesting solutions to help them achieve their aims.

Examining the company’s current organizational structure, analyzing data to identify problems caused by the company’s existing systems and processes, forecasting outcomes, challenges and potential risks of utilizing any advancements, and implementing appropriate software to create solutions to enhance business processes are some of your responsibilities.

Risk analyst

As a risk analyst, you’ll advise organizations on the risks of new and existing projects and identify elements that could harm the company’s bottom line. Operational risks (unexpected failures in your company’s day-to-day operations, such as a significant power outage), compliance risk (whether or not a corporation follows the rules and regulations), and financial risk are examples of these risks (e.g., things that can affect revenue).

Risk analysts are expected to have excellent organizational and decision-making abilities, as well as a clear business sense, the ability to interpret complex numerical data, and excellent communication skills. You will also have the opportunity to work in some settings, including commercial firms, insurance companies, and government agencies.

Underwriter

An underwriter considers the risks involved in protecting the policyholder based on characteristics such as age, health, and occupation when deciding whether or not to accept applications for insurance coverage.

Underwriters are responsible for preparing insurance policies, gathering and analyzing statistical data on potential policyholders, and conducting risk evaluations. This entails determining whether the insurance firm can afford to take on these policyholders’ risks (e.g., an older adult, a person with a dangerous job, someone with an existing medical condition). The underwriter will then price the insurance premiums based on this judgment.

A good underwriter possesses excellent analytical skills, attention to detail, sound decision-making ability, and an affinity for mathematics, statistics, and information technology systems.

Conclusion

We hope we’ve successfully debunked the idea that an Actuarial Science degree will lead you down a narrow road to a limited number of professional options. Despite being a specialist topic of study, the abilities you will gain during your degree will undoubtedly make you an invaluable asset to any firm, regardless of industry.

All these entry-level actuarial science jobs are perfect to kick-start your career. For more fantastic content, stay connected.

Dog Head Collar Adjustable And Padded No Pull Training Tool For Dogs On Wal

Dog Head Collar Adjustable And Padded No Pull Training Tool For Dogs On Wal

Smead 100 Recycled Pressboard Classification File Folder 1 Divider 2quot Expan

Smead 100 Recycled Pressboard Classification File Folder 1 Divider 2quot Expan

Classic Accessories Veranda Water Resistant 11 Foot Patio Umbrella Cover

Classic Accessories Veranda Water Resistant 11 Foot Patio Umbrella Cover

Sandisk 16 Gb Class 10 Sd Hc Ultra Flash Memory Card 10 Pack Bundle With

Sandisk 16 Gb Class 10 Sd Hc Ultra Flash Memory Card 10 Pack Bundle With

Fairwin Braided Leather Dog Training Leash 6 Foot 56 Foot Military Grade H

Fairwin Braided Leather Dog Training Leash 6 Foot 56 Foot Military Grade H

3m Reflective Dog Leash 5ft Long With Traffic Padded Handle Dog Training Leas

3m Reflective Dog Leash 5ft Long With Traffic Padded Handle Dog Training Leas

How To Be Your Dogs Best Friend The Classic Training Manual For Dog Owners

How To Be Your Dogs Best Friend The Classic Training Manual For Dog Owners

Classical Naptime For Tots

Classical Naptime For Tots

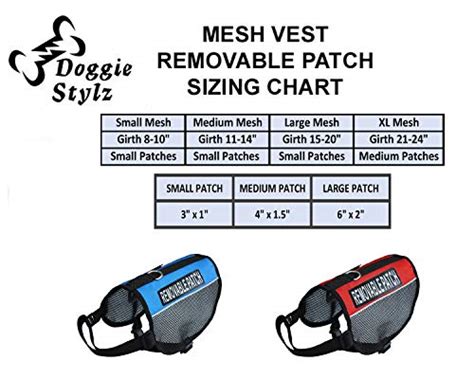

Doggie Stylz Set Of 2 Reflective Therapy Dog In Training Removable Patches Wit

Doggie Stylz Set Of 2 Reflective Therapy Dog In Training Removable Patches Wit

6 Pcs Service Dog In Trainingworkingstress Amp Anxiety Response Embroidere

6 Pcs Service Dog In Trainingworkingstress Amp Anxiety Response Embroidere

Service Dog In Training Patch With Hook Back And Reflective Lettering For Servic

Service Dog In Training Patch With Hook Back And Reflective Lettering For Servic

Four Paws Wee Wee Pee Pads For Dogs And Puppies Training L Gigantic Xl St

Four Paws Wee Wee Pee Pads For Dogs And Puppies Training L Gigantic Xl St