No matter where we are working, what is our experience and age: wealth does not come easily to us. Especially in the case of having no job, it really matters. Therefore, in our working age, especially in the last ten years, working-age people start worrying about life after retirement. It is because, in their life, they did not plan anything, but when they feel that they do not have much time, it makes them worried.

Not many people focus on retirement planning and it costs them in their future. Studies have shown that more than 21 percent of people are not saving while more than half of people are behind in saving for retirement. So, in short, we can say that more than half of people are at a risk of not maintaining their living standards after retirement.

Keeping in view the risks mentioned earlier, some people are really working on it to keep track of the way after retirement. In this situation, the most asked question is how much money we should save before retirement to live a happy life. In that case, there is no exact figure which can tell the exact amount to spend a happy life after retirement. But studies have shown that one should have probably a multiple of 25% of his annual income saved to spend his life happily after retirement.

Dan Tobias, a certified financial planner at Passport Wealth Management in the Charlotte, North Carolina area, has tried to redirect the straightforward question: How much money will you need to retire. After understanding a person’s vision, Tobas apply some rules to meet their retirement plans. For this purpose, Fidelity investments recommend certain level should be achieved to ensure that you are saving enough:

- At the age of 30, you should have at least an annual income saved.

- After the age of 40, you should have three-time of your annual income saved.

- After the age of 50, six-time of your annual income.

- After the age of 60, ten-time of your annual income.

- While at the age of 67, you should have at least 16 times your annual income saved.

For this purpose, there are certain accounts that one should know to save for their retirement and even if you lack the skills of wealth management, you can benefit from these accounts. The Employee Benefits Security Administration ensures these plans and providers, which is a part of the US Department of Labor. There are several types of accounts depending upon your needs. These accounts have some limitations of investments, but we must benefit from them. If you have reached one account’s limit, you can invest in another account.

401K Retirement account:

A 401K is a retirement account sponsored by the employer. A 401k plan provides a great opportunity to transfer a certain percentage from your salary directly into the plan. 401k plan provides the benefit of transferring your pre-tax salary into the plan to save for retirement. In this way, you have to pay the tax after receiving the deducted salary slip. So you don’t need to pay tax on this saved amount until you withdraw it as this account works by your employer’s contribution, so you get free money from your company.

Individual Retirement Accounts ( IRAs ):

As mentioned in the name, this is an individual account which means anyone can open it. These accounts do not need to work through your employer. There are multiple types of IRAs depending upon your financial situation.

- Traditional IRAs: (Similar to 401k to save pre-tax income but in some cases partially tax-deductible depending upon your income.)

- Roth IRAs: (Different from 401k plan, allow you to put your taxed money but avoid paying tax on your earnings, and you withdraw tax-free money.)

- Simple IRAs: (Works with the contribution of your employer, and both contributions are tax-deductible.)

- SEP IRAs: (For small business owners and both SEP and Simple IRAs work with employer contribution and follow the same tax-deferred advantage and withdrawals rules.)

These plans are considered the best plans, but there are also other options. There are also other multiple accounts available for retirement savings. Some of them are listed below: –

- High-yield savings accounts and investment accounts

- HSAs or Health Saving Accounts

- Social Security

- Pensions

Conclusion

If you want to have a comfortable life after retirement, you need to start saving today. But savings alone are not enough, you also need to reduce your expenses, invest your money, and manage taxes and loans properly. To do this in the right way and improve your financial health, you can take a personal finance course. We are sure it would help you greatly.

Fairwin Braided Leather Dog Training Leash 6 Foot 56 Foot Military Grade H

Fairwin Braided Leather Dog Training Leash 6 Foot 56 Foot Military Grade H

3m Reflective Dog Leash 5ft Long With Traffic Padded Handle Dog Training Leas

3m Reflective Dog Leash 5ft Long With Traffic Padded Handle Dog Training Leas

How To Be Your Dogs Best Friend The Classic Training Manual For Dog Owners

How To Be Your Dogs Best Friend The Classic Training Manual For Dog Owners

Classical Naptime For Tots

Classical Naptime For Tots

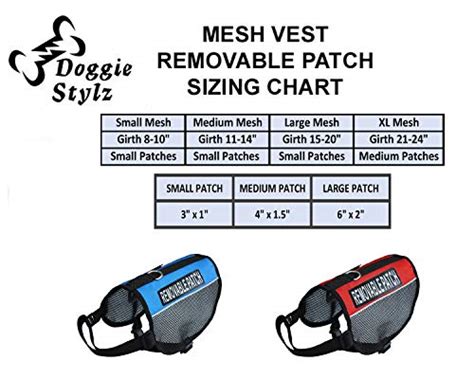

Doggie Stylz Set Of 2 Reflective Therapy Dog In Training Removable Patches Wit

Doggie Stylz Set Of 2 Reflective Therapy Dog In Training Removable Patches Wit

6 Pcs Service Dog In Trainingworkingstress Amp Anxiety Response Embroidere

6 Pcs Service Dog In Trainingworkingstress Amp Anxiety Response Embroidere

Service Dog In Training Patch With Hook Back And Reflective Lettering For Servic

Service Dog In Training Patch With Hook Back And Reflective Lettering For Servic

Four Paws Wee Wee Pee Pads For Dogs And Puppies Training L Gigantic Xl St

Four Paws Wee Wee Pee Pads For Dogs And Puppies Training L Gigantic Xl St

Pny 128gb Elite X Class 10 U3 V30 Microsdxc Flash Memory Card 100mbs

Pny 128gb Elite X Class 10 U3 V30 Microsdxc Flash Memory Card 100mbs

Academy Of Beasts V Shifter Romance

Academy Of Beasts V Shifter Romance

Beast Academy 5a Practice

Beast Academy 5a Practice

32gb Class 10 Sdhc Flash Memory Card Standard Full Size Sd Card Ush I U

32gb Class 10 Sdhc Flash Memory Card Standard Full Size Sd Card Ush I U

![Sales funnel courses and certification [2021] [UPDATED] Sales funnel courses and certification [2021] [UPDATED]](https://www.courses-for-you.com/images/uploads/thumbs/11-35.png)

![Flutter & Dart - The Complete Guide [2022 Edition]](https://img-c.udemycdn.com/course/100x100/1708340_7108_5.jpg)