Banking jobs are the ones within the banking industry. The good thing about a banking job is that it is available for almost anyone who wants to pursue this career path. To work in this field, you need to understand the pros and cons of a banking career. This article will discover what a banking career is, how to become successful in this field, and which banking career paths are in demand these days.

How to Begin Your Banking Career?

The banking sector offers an array of jobs now and then. With high salaries, insurance, and job security – banking jobs ranks among the best ones. To apply for banking jobs, it is necessary to graduate with an economics, banking, commerce, or finance degree. The minimum qualification to attain a promising career in banking is Bachelor’s. Besides, studying quantitative aptitude, reasoning, general awareness, and primary computer and English skills are also required to ace the jobs.

What are Banking Careers?

Before applying for a job, you need to understand what banking careers are clearly. Average banking careers include accountants, investment bankers, bank tellers, and bank administrators. Since banking is a service industry, the primary requirement is trustworthiness and honesty.

Why is Pursuing Banking a Good Option?

There are numerous benefits of choosing a career in banking. Here are a few reasons that’ll encourage you to select this career path.

- Job security and insurance.

- Competitive salaries.

- Opportunities for promotion and advancement.

- Reliable hours.

- Career development options.

- Variety of job options to choose from.

Other than this, banks also train their employees (the ones willing to learn on the job). This can help in learning and gaining experience quickly.

Types of Banking Career Options

There are numerous career paths that you can choose to pursue in this field. Here we have compiled a banking job list that you can opt for. Have a look.

Bank Teller

If you are looking for an entry-level job in banking, then a bank teller is the best choice. The position requires offering customer care services and basic banking facilities to clients. This includes taking checks, cash, and other payments for dispensing and depositing into the customer’s accounts. Other than this, a bank teller also assists customers with queries or any additional hassle they’re facing. The average salary of a bank teller is $25,770 per annum, which can increase or decrease depending on the annual increment.

Accountant

There needs to be someone who assures financial statements and records are updated. Their responsibility is to analyze and document financial information, personal audits, discrepancies in financial records, assist in company management, and make informed choices regarding their finances and budget. As an accountant, you can earn approximately $54,670 per year – quite enough for a banking job.

Investment Banking Associate

With an average salary of $57,500 – an investment banking associate job is one of the best. The task of an investment banking associate is to analyze the financial goals and requirements to suggest solutions to meet those requirements. Moreover, they can evaluate the financial information, create investment portfolios for customers, uphold the customer relationship, acquire new fund sources, carry out analyses, and supervise customer investment transactions.

Credit Analyst

Credit Analysts are in charge of concluding the risk profile and affluence of the businesses and individual clients. Their job is to run background checks, examine financial statements and credit history, carry out risk assessments, review credit application applications, and deal with customers regarding credit limits and payment terms. The average salary of a credit analyst is almost $59,400, which is revised annually.

Auditor

Also referred to as certified accountants – auditors mainly assist individuals and organizations in making sure their fiscal records are precise and meet compliance laws. They thoroughly examine the financial records, counsel organizations, and individuals, and help in financial plans for the future. The average salary of an auditor ranges between $67,500 and $80,000, depending on the seniority.

Conclusion

Banking careers are among the best ones. Banking jobs are the most stable with handsome salary packages, job security, insurances, and many other benefits.

In this article, we’ve discussed why this career path is suitable for you, what requirements you need to fulfill and which job options are among the best.

For more informative articles, stay connected.

Classical Naptime For Tots

Classical Naptime For Tots

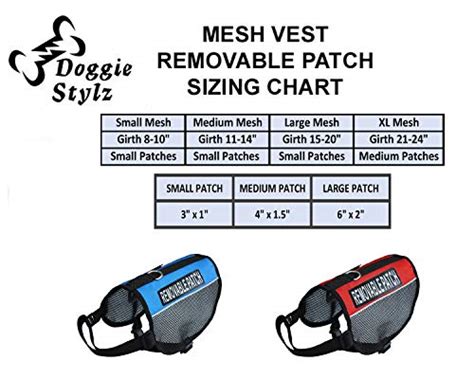

Doggie Stylz Set Of 2 Reflective Therapy Dog In Training Removable Patches Wit

Doggie Stylz Set Of 2 Reflective Therapy Dog In Training Removable Patches Wit

6 Pcs Service Dog In Trainingworkingstress Amp Anxiety Response Embroidere

6 Pcs Service Dog In Trainingworkingstress Amp Anxiety Response Embroidere

Service Dog In Training Patch With Hook Back And Reflective Lettering For Servic

Service Dog In Training Patch With Hook Back And Reflective Lettering For Servic

Four Paws Wee Wee Pee Pads For Dogs And Puppies Training L Gigantic Xl St

Four Paws Wee Wee Pee Pads For Dogs And Puppies Training L Gigantic Xl St

Pny 128gb Elite X Class 10 U3 V30 Microsdxc Flash Memory Card 100mbs

Pny 128gb Elite X Class 10 U3 V30 Microsdxc Flash Memory Card 100mbs

Academy Of Beasts V Shifter Romance

Academy Of Beasts V Shifter Romance

Beast Academy 5a Practice

Beast Academy 5a Practice

32gb Class 10 Sdhc Flash Memory Card Standard Full Size Sd Card Ush I U

32gb Class 10 Sdhc Flash Memory Card Standard Full Size Sd Card Ush I U

Go Power F 200 Class T 200 Amp Slow Blow Fuse Silver

Go Power F 200 Class T 200 Amp Slow Blow Fuse Silver

Blue Sea Systems 5116 Fuse A3tclass T 200a

Blue Sea Systems 5116 Fuse A3tclass T 200a

Eureka Peanuts Classic Characters Deco Kit 840227

Eureka Peanuts Classic Characters Deco Kit 840227