Ifrs 9 Financial Instruments Practical View

Tags: IFRS

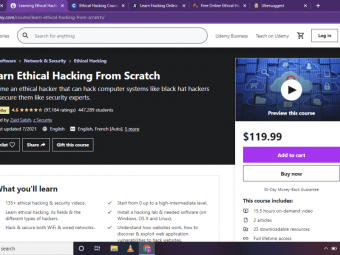

Become an IFRS 9 guru

Last updated 2022-01-10 | 4.5

- Initial recognition and initial measurement of financial instruments- Classification of financial instruments (financial assets and financial liabilities)

- Subsequent measurement of financial assets (amortized cost

- FVTPL

- FVTOCI)

What you'll learn

* Requirements

* Basic knowledge in financial accountingDescription

In this course, you will learn from scratch how to deal with accounting issues in respect of financial instruments within the scope of IFRS 9. The topics covered in this course are:

- Measurement methods (amortized cost and fair value);

- Initial recognition and initial measurement of financial instruments;

- Classification and subsequent measurement of financial instruments (at amortized cost, FVTOCI and FVTPL);

- Reclassification of financial assets;

- Derecognition of financial assets;

- Classification and reclassification of financial liabilities (at amortized cost and FVTPL);

- Subsequent measurement of financial liabilities;

- Derecognition of financial liabilities;

- Embedded derivatives;

- Impairment for financial instruments (expected credit losses, probability of default, exposure at default etc.);

- Hedge accounting (cash flow hedge and fair value hedge).

The content is fully practice oriented. A lot of numerical questions will be practiced to make you get hands-on skills regarding accountancy of financial instruments.

Once you finish the course, you should have obtained both theoretical knowledge and hands-on skills to tackle problems relating to accountancy of financial instruments. Having acquired necessary knowledge and practical skills, you shall be able to cope with accounting problems arising in your daily job life.

The course would be beneficial to accounting and finance professionals as well as students preparing for taking on accountancy qualifications.

Who this course is for:

- Reporting specialists and those working in finance and accounting sector

Course content

13 sections • 47 lectures

This course includes:

This course includes:

![React Native - The Practical Guide [2022 Edition]](https://img-c.udemycdn.com/course/100x100/1436092_2024_4.jpg)